GameStop has been in business for decades, while Rocket is a relatively new company that just came public last summer. Is it different this time?īeyond short interest, Rocket and GameStop don't have a lot in common. That has prompted lengthy discussions of the mortgage stock on the WallStreetBets Reddit forum. Indeed, short interest in Rocket is extremely high, at more than 45% of the stock's available float, according to S3. They point to volume that was 10 times greater than in Monday's session as possible evidence of coordinated action, with a note from financial analytics company S3 Partners provocatively titled "Rocket Shorts Are Crashing and Burning." Many market participants are speculating that Rocket has become the latest example of a GameStop-like short squeeze. What happened on Tuesday seemed to confirm that more was going on. Monday's 11% gain built some upward momentum above and beyond what any new information gave traders. Rocket even announced a special dividend of $1.11 per share.īut that news took the stock up only 10% on Friday.

Rocket saw a 60% rise in the number of visitors to its website and app to more than 150 million, and the company also saw ancillary businesses in areas like auto loans and digital home buying and selling show promising signs of growth. The mortgage specialist said that its fourth-quarter revenue had jumped 144% from the same period in the prior year, with loan originations more than doubling as well. The initial move upward for Rocket's stock last week came after the company issued an extremely strong earnings report. That added to gains in recent sessions that together caused the stock to double just in the past week. Shares of Rocket shot higher by more than 70% on Tuesday. Tuesday's market session might have revealed an answer, as comments surrounding mortgage company Rocket (NYSE: RKT) bore an uncanny resemblance to some of the discussions that happened with the video game retailer in late January and early February.

Since then, many have wondered whether there might be another stock that will get the same treatment that GameStop did. It's been about a month since the saga of GameStop (NYSE: GME) captured the attention of investors and non-investors alike. Market participants seemed ready again to punish high-flying growth stocks in favor of alternatives. The Dow Jones Industrial Average (DJINDICES: ^DJI) and S&P 500 (SNPINDEX: ^GSPC) managed to limit their losses to less than 1%, but the Nasdaq Composite (NASDAQINDEX: ^IXIC) wasn't as lucky.

Rocket stock game software#

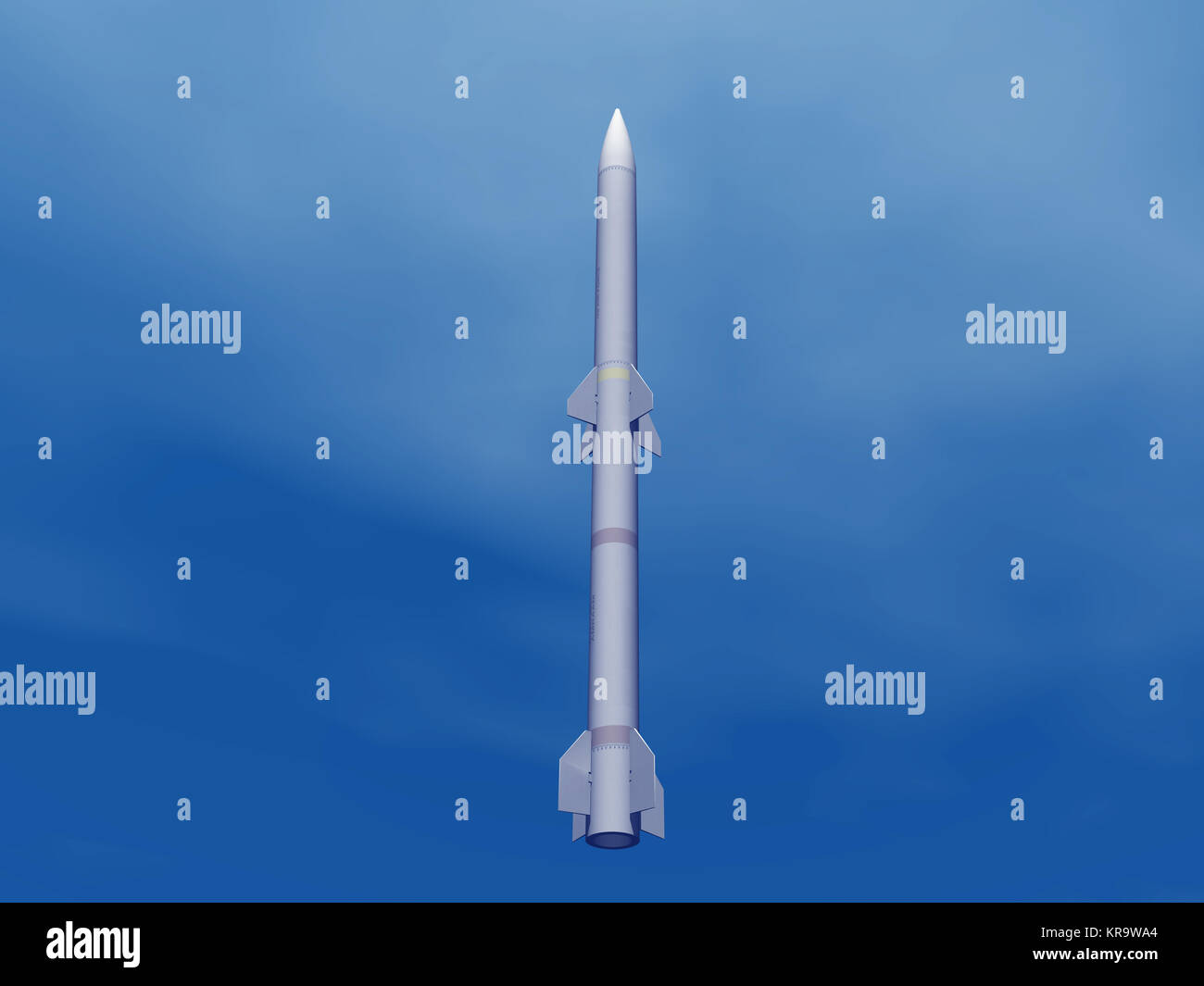

Software description provided by the publisher.After a one-day reprieve that brought the stock market one of its best days in the past year, Wall Street had a late-day sell-off on Tuesday that took all three major market benchmarks into the red. Give it up for "STEPAN" – an intercontinental ballistic missile, an engineering marvel and a hellish combination of power and splendor.

The enemy never sleeps, and he’s incredibly cunning.Although Boris is physically fit, there is always room for improvement! Enhance the capabilities of Boris's body which helps him work better.Only under such conditions can people truly become real heroes and patriots of their homeland.ĭo not let Mother Russia be ruined! Do or die! Death itself is not a good enough excuse for a Soviet man! Even your mortal body belongs to the State. These are the times when duty to your country is more important than your own opinion. You will have to withstand freezing weather and nasty bear intrigues while slurping condensed milk to survive and adapt to the rapidly changing environment.įull immersion in the dramatic atmosphere of the Cold War. You will have a chance to defend your vast Motherland single-handedly.

Rocket stock game simulator#

BORIS THE ROCKET is a simulator of a moustached Cold War Soviet missile operator.

0 kommentar(er)

0 kommentar(er)